Master Crypto Trading with the Turtle Method

Forget about risky trades and quick losses. The Turtle Method is designed for stable, long-term growth in crypto trading—without the stress.

Why Most Traders Lose & How You Can Win With the Turtle Method

📉 Most traders fail because they:

❌ Chase high-risk trades without a strategy

❌ Overuse leverage and get liquidated

❌ Let emotions dictate their decisions

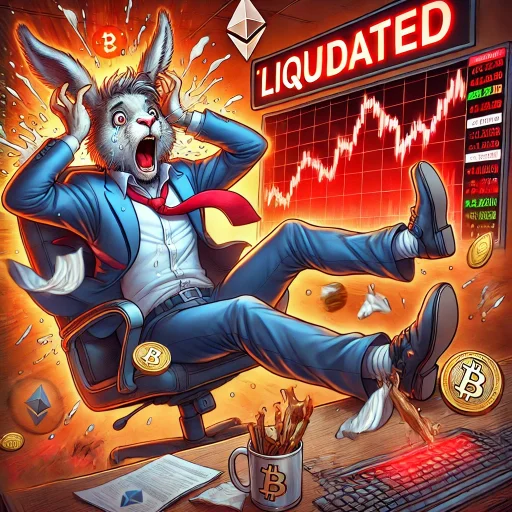

The Hare Trader chases quick profits with high-risk trades, excessive leverage, and emotional decisions. This approach often leads to liquidation, frustration, and losses that wipe out entire accounts. Fast moves without a plan may seem exciting, but without risk management, they usually end in failure.

📈 But the Turtle Method is different:

✅ Steady daily growth strategy (2-5% daily, NOT gambling)

✅ Risk management first – Protect your capital at all times

✅ No stress trading – Trade with confidence, not fear

The Turtle Trader follows a disciplined, well-structured strategy focused on steady growth, risk management, and long-term success. Instead of gambling on high-risk trades, this approach ensures consistent profits while minimizing losses. The result? Sustainable financial growth without stress.

The Turtle Method

Learn how consistent, small gains (2-5% per day) can outperform risky, high-leverage trades. This lesson introduces the Turtle Method, explaining why patience, discipline are the keys to long-term success in trading.

Risk Management

Discover the most common trading mistakes and how to avoid them. Learn how to use stop-loss orders, manage liquidation risks, and properly size your positions to ensure your trading account survives market fluctuations.

Trading Psychology

Learn to control emotions, avoid FOMO (fear of missing out) and panic selling, and develop the psychology of a professional trader. Understand why most traders fail due to emotional decisions—and how you can rise above them.

Make the right choice

Who Should Take This Course?

Is this course suitable for you and your needs: Let’s find out! You can also try our sample lesson – first lesson about turtle method is completely free!

Beginners

No prior trading experience? Start the right way! Learn from our mistakes and make the right choices!

Struggling traders

Stop making emotional mistakes & losing money. If you struggle with emotional trading and often lose money, try turtle method.

Investors

Wanna learn something new? Learn to maximize gains without unnecessary risk.

FAQ (Common Questions)

How is the Turtle Method different from other trading courses?

Most courses focus on high-risk strategies and fast profits, which often lead to liquidation. The Turtle Method is built for long-term, consistent growth with a focus on risk management and steady profits—not gambling.

Do I need any prior trading experience?

No! The Turtle Method starts from the basics of crypto trading and gradually moves into advanced strategies. Whether you’re a beginner or someone struggling with trading, this course will provide step-by-step guidance.

How much does the Turtle Method Course cost?

The course is a one-time payment with no hidden fees or subscriptions. Pricing for the course is 299USD, but huge discounts are available often!

Is my payment secure?

Yes! All transactions are processed through Paygate.to, a secure crypto payment gateway, ensuring safe and encrypted transactions. You pay with card, we receive crypto.

Can I get a refund if I don’t like the course?

Yes. You can request a refund of 90% within 7 days of purchase if you haven’t accessed the course. However, if you used a promo code, your refund will be 50% of the price paid instead of 90%.

What topics does the Turtle Method cover?

The course covers everything you need to master crypto trading, including:

-

The Turtle Method Strategy (how slow, steady growth beats high-risk trading)

-

Risk Management (protecting your capital from liquidation)

-

Trading Psychology (avoiding emotional trading mistakes)

-

Technical Analysis (when to buy and sell)

-

Leverage & Futures Trading (using margin safely)

Will I get updates if new lessons are added?

Yes! If we release updates or new lessons within your access period, you’ll get them for free.

Do I need a specific crypto exchange to follow the course?

No, but we primarily use Binance and Coinbase for examples. The strategies can be applied to any major exchange.

How can I contact you if I have questions?

You can email us at turtle@turtle-method.com for any inquiries.

Is there a community or forum where I can discuss the course?

Not currently, but we’re exploring options for a private Discord or Telegram group for students.